The Roadmap to ESG Excellence: Insights for Real Estate Players

The annual ESG in Practice event, hosted by the Workplace Futures Group, was a real eye-opener! Bringing together asset managers and landlords, this event served as the ultimate guide to mastering the ins and outs of Environmental, Social, and Governance (ESG) principles.

We were so impressed with the success of the event that we decided to write a series of articles that capture all the key takeaways from the event. For our first article of the series, we have summarised the key information shared by ESG Property expert Adam Hinds, from LifeProven. Consider this your one-stop shop for easily digestible ESG knowledge.

What is ESG?

ESG, the acronym encompassing environmental, social, and governance factors, delves into three vital dimensions. Environmental pertains to your impact on the planet, while Social examines your influence on people. Lastly, Governance addresses your role in promoting resilience. These three facets, each encompassing a wide spectrum, meticulously account for both internal (corporate) and external (development and operation) ramifications.

What is driving the ESG agenda?

Macro Forces + Micro Forces = Changing Risks and Opportunities

The equation is simple yet profound: when Macro Forces and Micro Forces converge, the result is a landscape of shifting risks and tantalising opportunities. At the heart of this equation lie the Macro Forces, representing the sweeping challenges that reverberate through society, affecting individuals and organisations alike. The dynamic interplay of these forces is a constant, a dance of change that includes:

- Climate Change

- Biodiversity Loss

- Social Inequalities

- Resource Shortages

- Economic Crises

- Geopolitical Instability

Complementing this intricate equation are the Micro Forces, those dynamic market factors sculpted by governmental and institutional hands that shape the functionality of capital and real estate markets. Among these perpetual shapers are:

- Changing Legislation & Regulations

- Changing Financial Insurance Markets

- Changing Reporting Requirements

- Changing Customer & Supply Chain Expectations

Together, these forces form the matrix of change, where challenges meet opportunities, and the future is constantly forged.

Changing Risks and Opportunities

The ever-changing macro and micro market forces continuously influence real estate throughout its life cycle. This constant evolution brings about fresh risks and opportunities at every investment stage. Key stakeholders, including Investors, Funders, Customers, Design Teams, Contractors, Agents, Local Authorities, and others, are all affected by this dynamic interplay.

Let’s break down the stakeholders:

Local Authorities, working with limited resources, aim to improve their communities’ climate, health, and job opportunities. Aligning their commitments with relevant applications not only helps them achieve their goals but also enhances their image as long-term local partners.

Insurers, focused on risk, face increased claims and risks due to climate change. Properties in vulnerable locations with changing climates might see higher premiums, reduced insurer interest, or even become uninsurable, impacting their value.

Future Potential Purchasers are concerned about risk, resilience, marketability, reputation, impact, and financial return. Providing clear ESG (Environmental, Social, and Governance) evidence helps buyers understand an asset’s unique ESG benefits, guarding against depreciation and securing better funding and support for the purchase.

In this intricate landscape, changing market forces shape outcomes, and savvy stakeholders navigate these shifts to create a future where risks and opportunities are carefully balanced.

Key ESG considerations

In this section, we will cover 4 key considerations that an asset manager or landlord should know or be aware of if they are to successfully operate in today’s market.

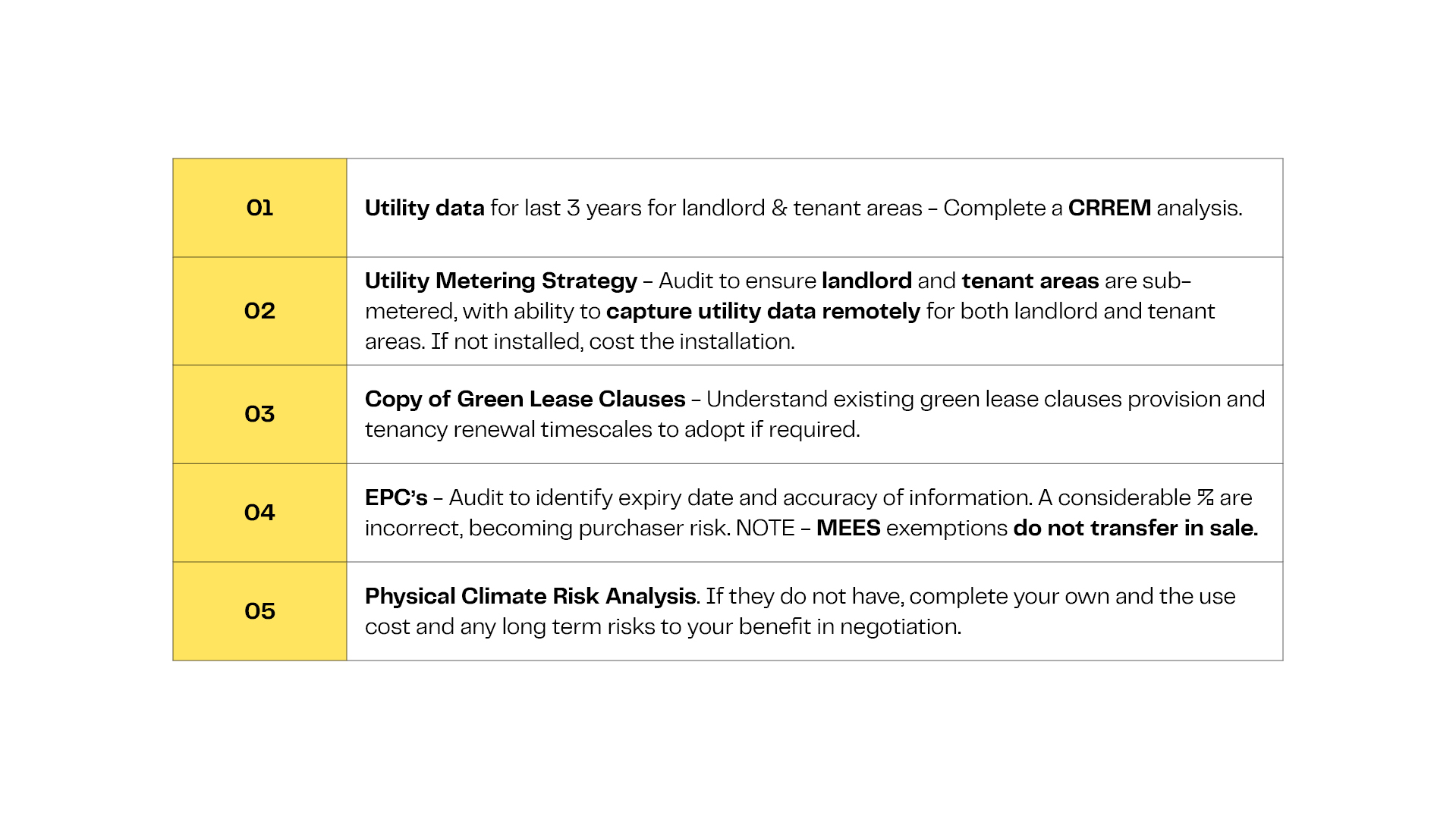

How to negotiate brown discounts in a purchase

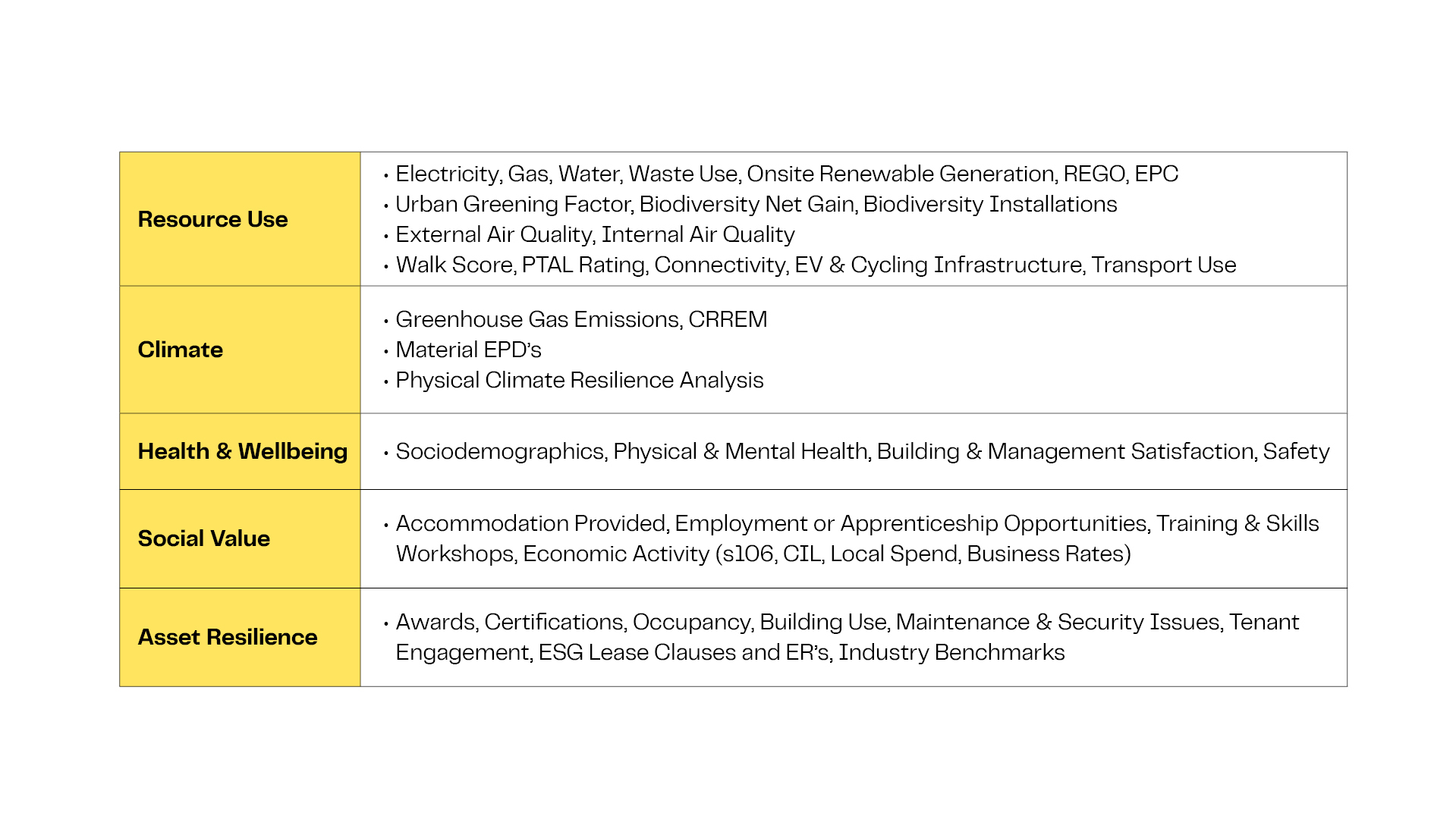

The ESG information you must capture in your operational assets.

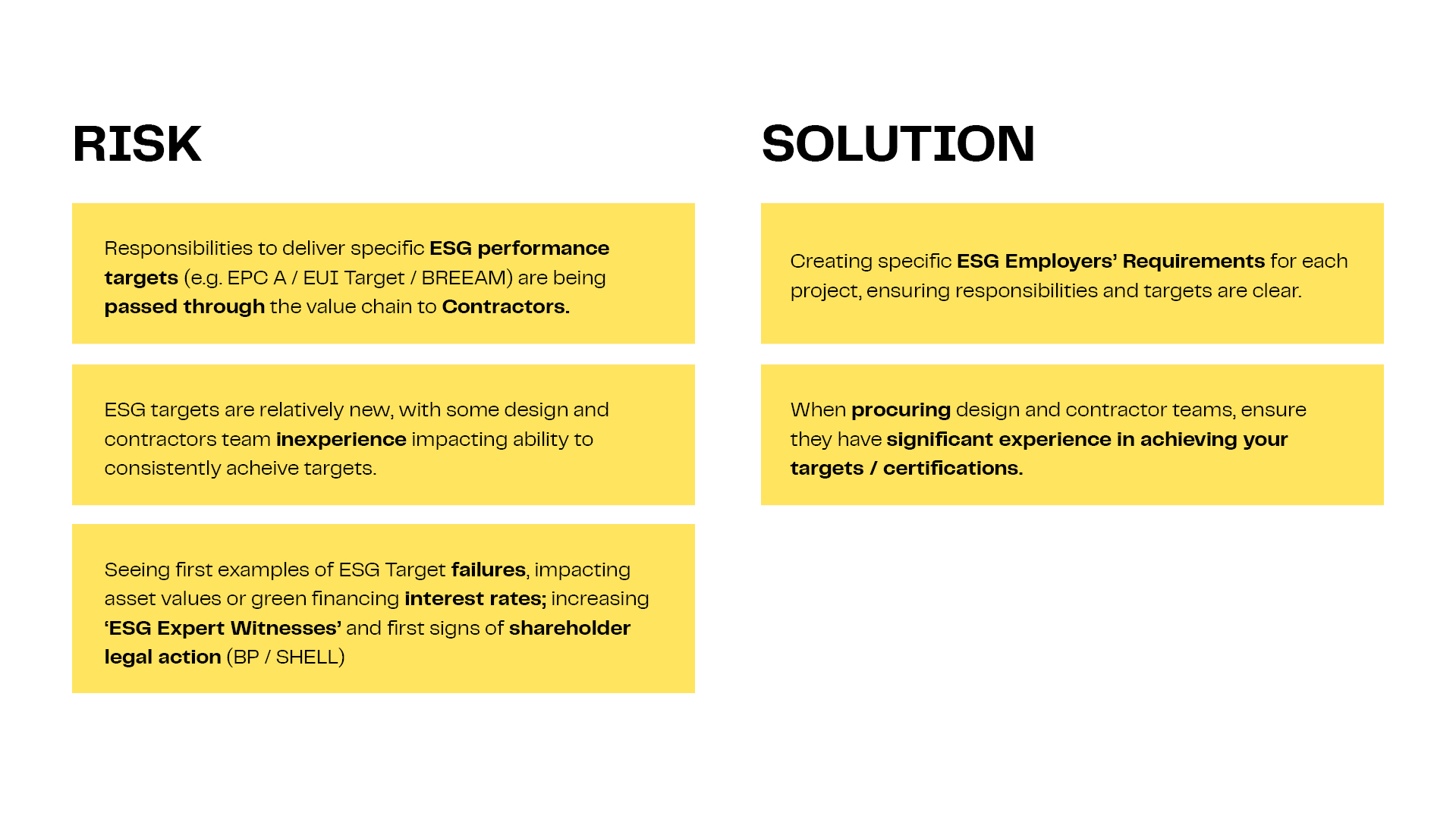

A key consideration to mitigate ESG risks in procurement.

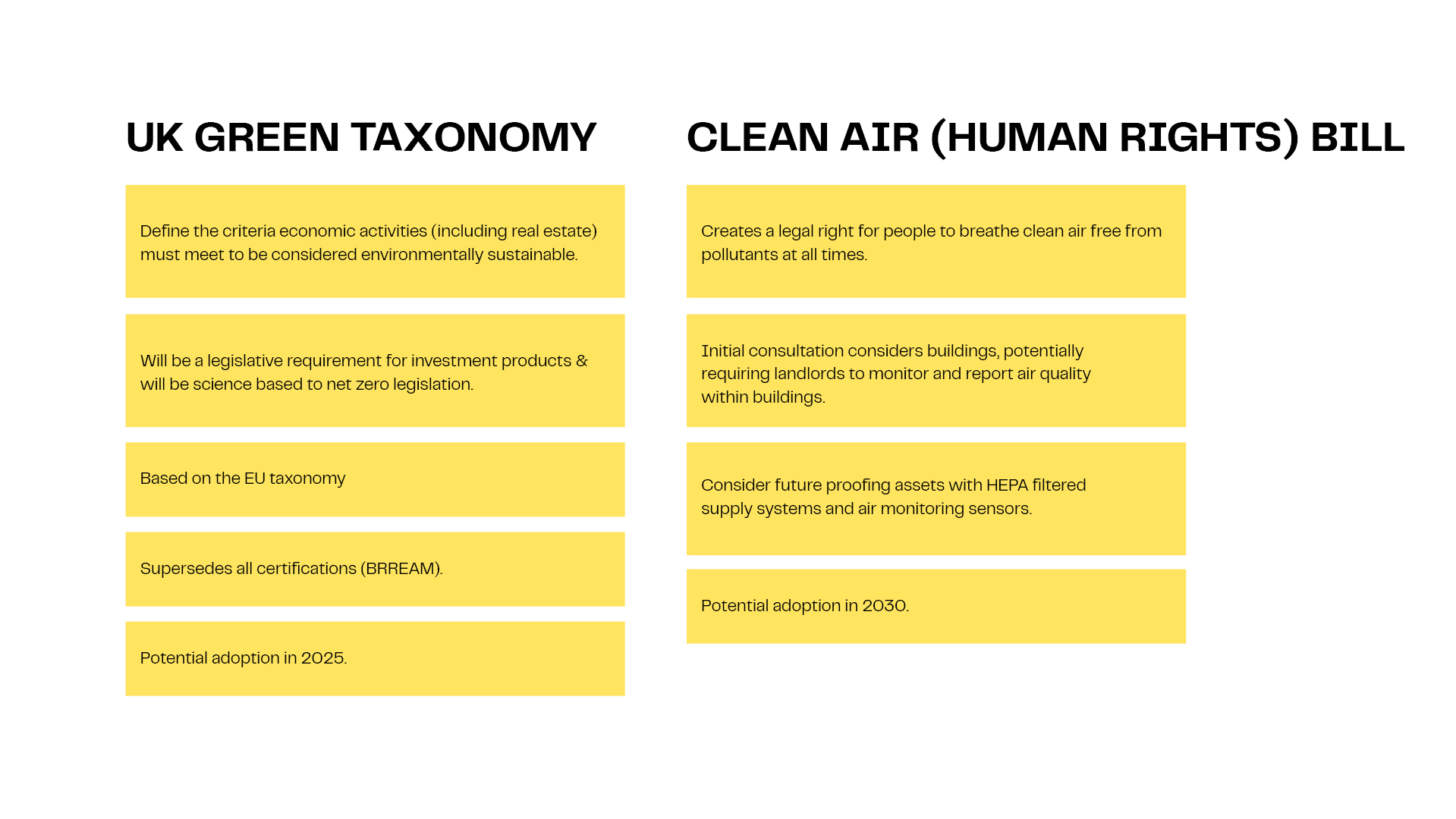

The ESG legislation currently in consultation that you need to know.

Find out more about our approach to ESG here.